Parent Plus loans are federal loans acquired by parents to fund their dependent’s undergraduate education. These loans allow parents to borrow up to the full cost of attendance, potentially leading to substantial debt burdens.

An increasing number of parents face challenges in finding affordable repayment options, primarily because they become eligible for just one Income-Driven Repayment (IDR) plan, known as Income Contingent Repayment (ICR), once they consolidate their Direct Parent Plus loans. ICR obliges borrowers to pay 20% of their discretionary income, often rendering it cost-prohibitive and limiting their ability to pursue forgiveness programs such as Public Service Loan Forgiveness.

However, there exists a temporary solution. Until July 2025, some Parent Plus loan borrowers may have the opportunity to utilize the “Double Consolidation Loophole,” which can grant them access to more economical Income-Driven Repayment plans like SAVE.

Important Deadline:

The Department of Education is aware of this loophole and intends to close it by July 2025. To take advantage of this opportunity, it is advisable to complete all consolidations before the deadline. While we cannot guarantee the loophole’s effectiveness, there is generally no downside to exploring this option.

What is the “Double Consolidation Loophole”?

It’s a series of consolidations (often three) that, when completed, may allow you to enroll in an affordable repayment plan such as SAVE.

What is the process?

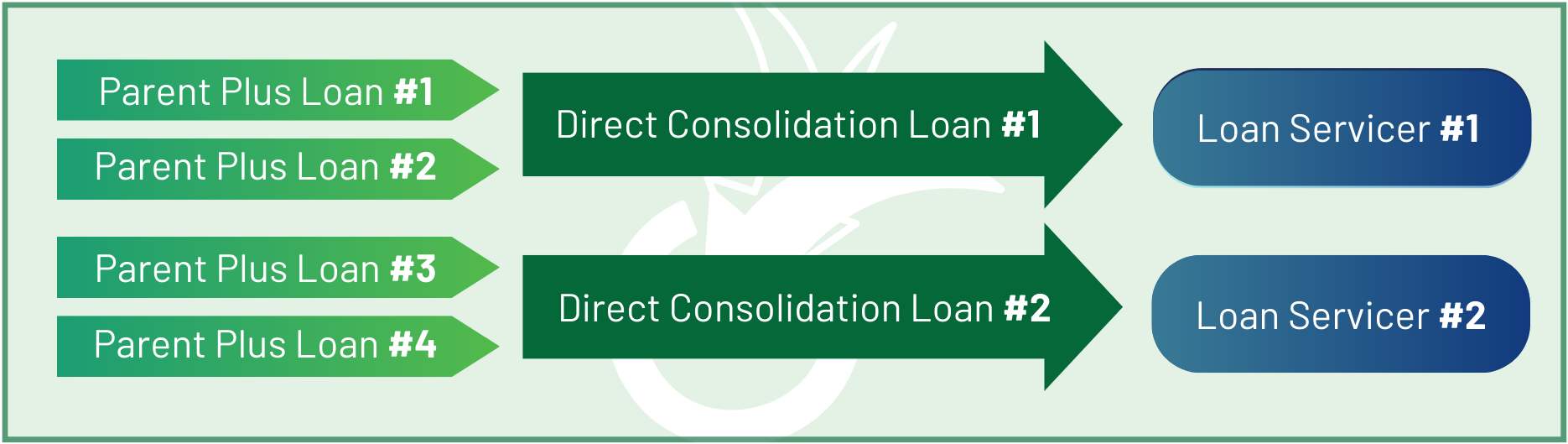

The following describes what to do if you have only unconsolidated Parent Plus loans:

Step 1:

- Do two separate consolidations and direct each consolidation to a different servicer. You can combine the loans any way you want, and you can consolidate a single Parent Plus loan if necessary. It may take up to 2 months to complete these consolidations.

- Repayment Plan: You must submit an application for a repayment plan anytime you do a consolidation. We recommend you apply for the Standard Fixed plan. This is temporary, is administratively easier and will expedite the process. (See below for forms)

Step 2:

- When the first two consolidations have been completed, file a third and final consolidation application that will combine the two Direct Consolidation loans into one.

- Repayment Plan: We also recommend you apply for the Standard Fixed plan during this consolidation.

Step 3:

- When the final consolidation is completed, you enroll the loan in the SAVE plan.

We recommend you complete all applications (Consolidation and Repayment Plan Requests), on paper!

What’s the process if you have unconsolidated Parent Plus loans and Direct Consolidation loans that contain Parent Plus loans?

Step 1:

- Consolidate the unconsolidated Parent Plus loans. Send this loan to a different servicer than the Consolidation loan.

- Repayment Plan: You must submit an application for a repayment plan anytime you do a consolidation. We recommend you apply for the Standard Fixed plan. This is temporary, is administratively easier and will expedite the process. (See below for forms)

Step 2:

- When you finish consolidating the Parent Plus loans, file the second and final consolidation application that will combine the two Direct Consolidation loans into one.

- Repayment Plan: We also recommend you apply for the Standard Fixed plan during this consolidation.

Step 3:

- When the final consolidation is completed, you enroll the loan in the SAVE plan.

We recommend you complete all applications (Consolidation and Repayment Plan Requests), on paper!

Paper Application Forms:

- Direct Consolidation Loan (DCL) Application and Promissory Note

- Direct Consolidation Loan (DCL) Application Instructions (See page 2 for loan codes)

- Additional Loan Listing Sheet (Use this form if you run out of space listing loans you wish to consolidate or those you don’t wish to consolidate)

- Repayment Plan Request (Used to enroll in a Standard Plan. File one form with each DCL Application)

- Income Driven Repayment (IDR) Plan Request (Used to enroll in the SAVE plan after all consolidations have been completed)

Paper Application Mailing Addresses:

Aidvantage

PO Box 300005

Greenville, Texas 75403-3005

Ph. 1-800-722-1300

EdFinancial

C/O Aidvantage

PO Box 300008

Greenville, Texas 75403-3008

Ph. 1-800-722-1300

Nelnet

PO Box 82658

Lincoln, Nebraska 68501-2658

Ph. 1-888-486-4722

MOHELA

C/O Aidvantage

PO Box 300006

Greenville, Texas 75403-3006

Ph. 1-800-722-1300

FAQs:

- If you have only Parent Plus loans, in most cases, if the double consolidation process doesn’t work, you will be no worse off than you currently are. You will still have access to traditional plans and the ICR plan.

- If you have Parent Plus loans and your own student loans, seek guidance before you consolidate.

- The multiple consolidations eliminate the trace of Parent Plus loans in the final consolidation loan, thus making it eligible for repayment plans other than ICR.

- Allow at least two months for each consolidation. On average the process should take about four months to complete.

- It could take longer if you are pursuing PSLF.

Will I lose qualifying payment credit for Public Service Loan Forgiveness (PSLF) when I consolidate?

- Under the new PSLF rules, you will receive weighted average credit for PSLF when you consolidate. But you should get a PSLF qualifying payment count on all your loans prior to consolidation.

- File the PSLF Certification and Application form(s) to verify your employment by using the PSLF Help Tool from your FSA account at studentaid.gov.